Handling customer support, tracking sales and inventory, and paying bills are all vital functions for a small business owner like myself. Managing all these tasks makes it easy to overlook the proper insurance coverage airplane. Business insurance may seem dull, however, safeguarding your assets is incredibly important.

Managing insurance is made easier and cheaper by having policies bundled together. You’ve probably heard of bundling before with home and auto insurance—but the benefits of bundling business insurance policies go far beyond convenience. It can actually save you money, simplify paperwork, and improve your overall coverage.

In this guide, you will learn how bundling policies works, regardless if you operate a small retail shop, scaling tech startup, or a service based firm.

Key Takeaways

- The bundling of business insurance policies can result in reduced premiums and enhanced coverage.

- It streamlines insurance management with a single contact and renewal date.

- Bundled packages can frequently be tailored to address specific risks of your business.

- Some insurers provide added benefits or bundled policyholder discounts not offered to single policyholders.

- For small and mid-size businesses, bundling helps maintain organization and enhance cost-savings.

Why Understanding the Benefits of Bundling Business Insurance Policies Matters

Every business encounters certain risks. As a business owner, property damage, lawsuits, employee injuries, cyber threats, and many other risks might pose continual challenges. For such risks, a business typically requires multiple policies, including but not limited to:

- General liability insurance

- Commercial property insurance

- Workers’ compensation

- Cyber liability

- Commercial auto insurance

- Business interruption coverage

Coordinating all of these policies becomes increasingly complex—and costs more. That is where the advantages of bundling business insurance policies come in. Instead of dealing with multiple carriers, agents, and due dates, all coverage is consolidated into one.

What Does It Mean to Bundle Business Insurance?

Bundling means obtaining multiple insurance policies from a single insurer, oftentimes as a part of a package deal. This works just like personal insurance. You are usually covered with general liability, commercial property, and other additional coverages. For such policies, insurers often provide you with:

- Reduced premiums

- Simplified claims processing

- Consolidated billing statement

- Single point of contact

The most common example is a Business Owner’s Policy (BOP). These types of bundles are tailored for small to mid-sized businesses and frequently include general liability, property insurance, and business interruption insurance.

Top Benefits of Bundling Business Insurance Policies

Let’s explore the primary reasons for bundling business insurance and understanding its appeal for many business owners in the United States.

You Save Money

This is the most appealing to a majority of business owners, and quite understandable,

Typically, when an insurer offers business insurance policies, they tend to provide a discount when multiple policies are purchased. Why is this so? It is mostly due to the fact that servicing one client with multiple policies is far easier and more resourceful than attending to numerous individual accounts. The savings are substantial.

Average Savings From Bundling:

| Insurance Policies Bundled | Estimated Savings |

|---|---|

| General Liability + Property | 10% – 20% |

| Liability + Property + Cyber | 15% – 25% |

| Full BOP Bundle | 20% – 30% |

These percentages can vary by industry and insurer, but they show how bundling adds up.

Simplified Management

Imagine the extraordinary burden of remembering an endless list of renewal dates, managing countless invoices, and dealing with some agents. That’s a headache you just don’t need.

- Increased efficiency while maintaining the same policies grants you:

- Single renewal date

- Single monthly or yearly payment

- Single agent or team assigned

After switching my business coverage to a bundled plan, I no longer missed renewal emails or billing notices. Everything being under one roof is much simpler, and time-saving is critical for me as a small business owner.

Better Coverage and Fewer Gaps

Recognizing overlaps or gaps in your protection is simpler when all coverage is consolidated into one account. Your business is viewed in totality, allowing your insurance provider to propose more suitable plans.

Here’s how that helps:

| Without Bundling | With Bundling |

|---|---|

| Risk of duplicate coverage | Clear, coordinated policies |

| Some risks may be left uninsured | Customized protection across all areas |

| Claims could be delayed or denied | Faster claims and less confusion |

When everything is managed together, you’re less likely to run into coverage issues during a crisis.

Streamlined Claims Process

Suppose, for example, that there’s a fire in your store. You would need to claim under your property insurance, business interruption insurance, and possibly your liability insurance if there are injuries.

If those policies are with different insurers, you’ll deal with multiple claims departments, adjusters, and forms. Bundling your policies simplifies the process because you:

- Work with one team

- File a single claim

- Get a faster payout

This helps you recover more quickly and get back to business.

More Leverage with Your Insurance Provider

With bundled business insurance policies, you become an even more attractive client and insurer. That often means:

- Better customer service.

- Priority claims support.

- Access to premium features or add-ons.

- Flexibility in how you customize your coverage.

Plus, if you ever want to make changes—like adding cyber coverage or increasing your liability limits—typically, these changes can be done in a single phone call instead of lengthy negotiations with several providers.

What Types of Business Insurance Can Be Bundled?

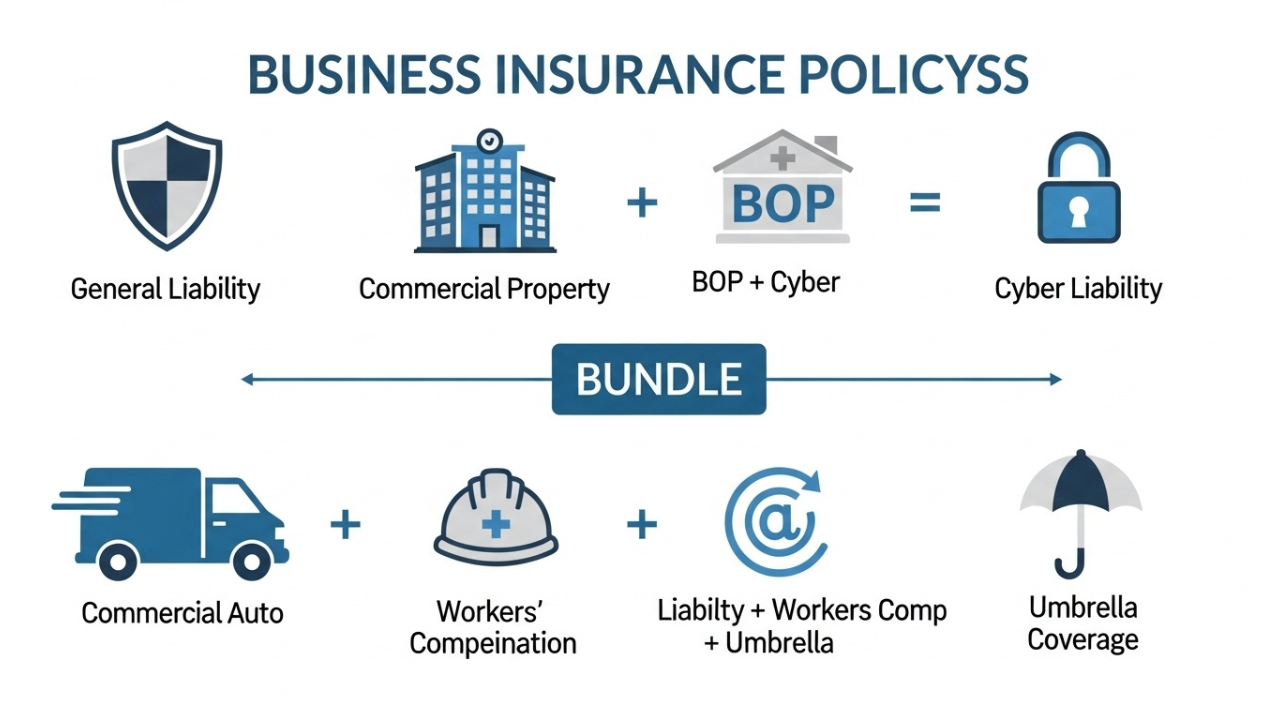

Most policies can be combined in accordance with your needs and your provider. Some well known Combos are:

- General Liability + Commercial Property = Business Owner’s Policy (BOP)

- BOP + Cyber Liability

- BOP + Commercial Auto

- Liability + Workers’ Comp + Umbrella Coverage

The key is to find an insurer that offers all the policies you need. Be sure to check as not all insurers provide the same packages.

Who Should Consider Bundling Business Insurance?

For business owners in the U.S. this is certainly a path worth exploring:

If you have multiple sites If you interact with customers or vendors face to face If you have customer data or use online databases If you operate business vehicles If you supervise business staff

No matter if you are a startup, a family owned business, or an emerging franchise, the advantages of bundled policies are applicable across a variety of sectors.

How to Bundle Business Insurance the Smart Way

Ready to get started on bundling your policies? Here’s an easy outline I developed when I was assessing my coverage.

Step 1: List All Your Existing Policies

Start with what you already have. Make a list of all the business insurance policies you carry—including your coverage amounts and provider names.

Step 2: Contact Your Agent or Shop Around

Reach out to your current agent or get quotes from a few companies. Let them know you’re interested in bundling and ask:

-

What types of bundles do you offer?

-

Are there discounts available?

-

Can I customize my bundle for my industry?

Step 3: Compare Coverage Side-by-Side

Make sure you’re not sacrificing important protections just to save money. You want to make sure your new bundle:

-

Matches or exceeds your current limits

-

Addresses all your business risks

-

Doesn’t leave major gaps

Common Mistakes to Avoid When Bundling Business Insurance Policies

While bundling has many benefits, it’s not foolproof. Here are a few mistakes to avoid:

-

Choosing price over protection. Don’t let a discount distract you from getting proper coverage.

-

Not reviewing the bundle annually. Your business changes. So should your insurance.

-

Overlooking policy exclusions. Read the fine print to understand what’s not covered.

-

Sticking with one insurer out of habit. If they stop offering competitive rates, shop around.

Real Example: How Bundling Saved a Local Business

Allow me to tell you a small story. A catering company business owner in Florida was a friend of mine. Previously, she had distinct liability, property and commercial auto policies which costed her a small fortune every month.

After consulting with a new agent, she was able to merge all three policies with a single provider. She not only saved over three thousand dollars annually, but also added a new business interruption insurance that covered her during the two week kitchen storm shutdown.

Oh, “It was one of the best financial decisions I ever made for my business,” she added later.

My Opinion| Are the Benefits of Bundling Business Insurance Policies Worth It?

I can see the reasoning. In most circumstances, bundling business insurance is not just a money saving tool. The logic for reduced expenses, reduced documents, expedited claims, as well as customized protection proves the advantages associated to bundling business insurance policies makes this change logical.

If it has been long since you last reviewed the business insurance, do it now. Make a call to your provider, ask the right questions, and analyze how effectively changing to bundling could help you secure your business.

Leave a Reply