The very first time I had to think about life insurance, I was flooded with options and insurance terms. Even today, people tend to wonder why there are two types of life insurances (term life vs whole life insurance). No matter what, this decision can be life changing as it determines the future of your family as well as their mental satisfaction.

Over time, I learned that both term life and whole life insurance have benefits, but they work very differently. I am not going to cover everything but will explain the most important points so that you can decide for yourself after considering my suggestions and decide based on your financial standing.

If recent news about changes in insurances have made you feel like a fool, don’t worry, I will try to help you out via this article. We’ll describe each type of insurance and their definitions, their advantages and disadvantages, how costly they turn out to be in the end, and things you should consider which are relevant to your aims.

Key Takeaways

Now, before moving deep into the lore of these insurances. Here is a brief summary based on my research of the benefits of term life and whole life insurances.

- If you want short term insurance, term life insurance is a perfect fit for you as it has low premium prices.

- Whole life insurance lasts throughout your life, but has a larger premium.

- Term life insurance is straightforward and simple, while whole life has redeemable investment benefits.

- Choosing between the two depends on financial goals and family needs.

- Regularly reviewing your financial needs makes it easier for you to adapt your policy to changing life circumstances.

What Is Term Life Insurance? Understanding the Basics

Hearing about term life insurance for the first time, I thought it was simple: coverage for a specific calendar period, like 10, 20, or 30 years. During the coverage period, if you pass away, your beneficiaries get the death benefit. Otherwise, the policy lapses and you lose everything.

With term life insurance, you are covered for a specified period which correlates with your most crucial financial responsibilities–mortgage, raising kids, or servicing debts.

How Term Life Insurance Works

Let’s assume you purchase a 20-year term policy for 500,000.Your monthly premiums will be lower than average, especially if you are young and healthy. Should you pass away any time during those twenty years, your family receives that The described policy expires after twenty years unless you choose to renew or convert it.

It’s like renting coverage for a limited duration.

What Is Whole Life Insurance? The Long-Term View

Whole life insurance is very different. It protects you for as long you continue paying premiums and additionally, provides a death benefit while simultaneously accruing cash value over time. This cash value can be borrowed against or withdrawn.

The first time I heard of cash value, I thought of it as something puzzling. In reality, it functions as a savings account contained within your policy. Your premium payment consists of two parts: an insurance cost and a portion that is invested and grows tax-free.

How Whole Life Insurance Works

If you acquire a whole life policy, your monthly payments are significantly higher, but you are constructing a financial resource that you can tap into later in life. The cash value can also aid emergencies, retirements or supplement income, and in addition to these functions, the death benefit comes guaranteed.

Term Life vs Whole Life Insurance Benefits: Side-by-Side Comparison Table

Let’s take a look at some of the main differences side-by-side. This table helped me wrap my head around it:

| Feature | Term Life Insurance | Whole Life Insurance |

|---|---|---|

| Coverage Duration | Fixed term (10, 20, 30 years) | Lifetime (as long as premiums paid) |

| Premium Cost | Lower, especially for younger buyers | Higher due to cash value component |

| Cash Value | None | Builds cash value over time |

| Death Benefit | Paid only if death occurs during term | Guaranteed payout anytime |

| Complexity | Simple and easy to understand | More complex, involves investment element |

| Flexibility | Limited to term length | Can borrow against cash value |

| Ideal For | Temporary financial protection | Long-term coverage and wealth building |

Who Should Consider Term Life Insurance?

Everybody must be considering, “Is term life right for me?” For someone like me looking into term life roughly a decade ago, provided the caveat that I had to manage the finances of a budding family and a home loan.

A life policy enables an individual to take up to a certain age and works until such time his mortgage is fully paid off. State pension benefits ensure that provisions are adequately met.

Budget.life.com is the first best solution when you are looking for more than just a placeholder.

Who Should Consider Whole Life Insurance?

Completely life insurance is suitable for individuals wanting lifelong coverage as well as a savings component. Upon researching, I found out that whole life insurance resembles a dual-purpose product with both insurance and investment benefits.

If you desire full protection, which cannot be revoked, alongside a financial asset available to you during your lifetime, then whole life insurance is worth considering.

Whole life insurance is mostly popular among people who want to leave a financial legacy for their heirs or supplement their income during retired years.

Cost Differences: What to Expect

The differences in both term life and whole life insurance premiums came as a big surprise to me.

The term life premiums tend to be much lower because the coverage is provided for a limited duration and does not accumulate cash value. Whole life premiums can be two to three times higher, especially during youth.

For a healthy 30-year-old male, here is an example with monthly premiums for $500,000 coverage:

| Policy Type | 20-Year Term Life Premium | Whole Life Premium (Same Coverage) |

|---|---|---|

| Monthly Cost | $25 – $40 | $150 – $300 |

While the numbers might look intimidating, remember whole life also acts as a forced savings account, which can offset some of the cost.

Understanding Cash Value: The Hidden Benefit of Whole Life

It was only after talking to an insurance advisor that I understood the cash value part of the policy. The growth rate of cash value is slow in the beginning, but increases after some time with more consistency, keeping in sync with the payment of premiums.

This cash value can be used as collateral to receive funds which can be used for emergencies or even to pay the premiums during tough financial times.

Understanding borrowing the cash value affects the death benefit is important. In the scenario where you do not repay the loan, the cash value of the policy shrinks by the amount owed, resulting in a decreased death benefit.

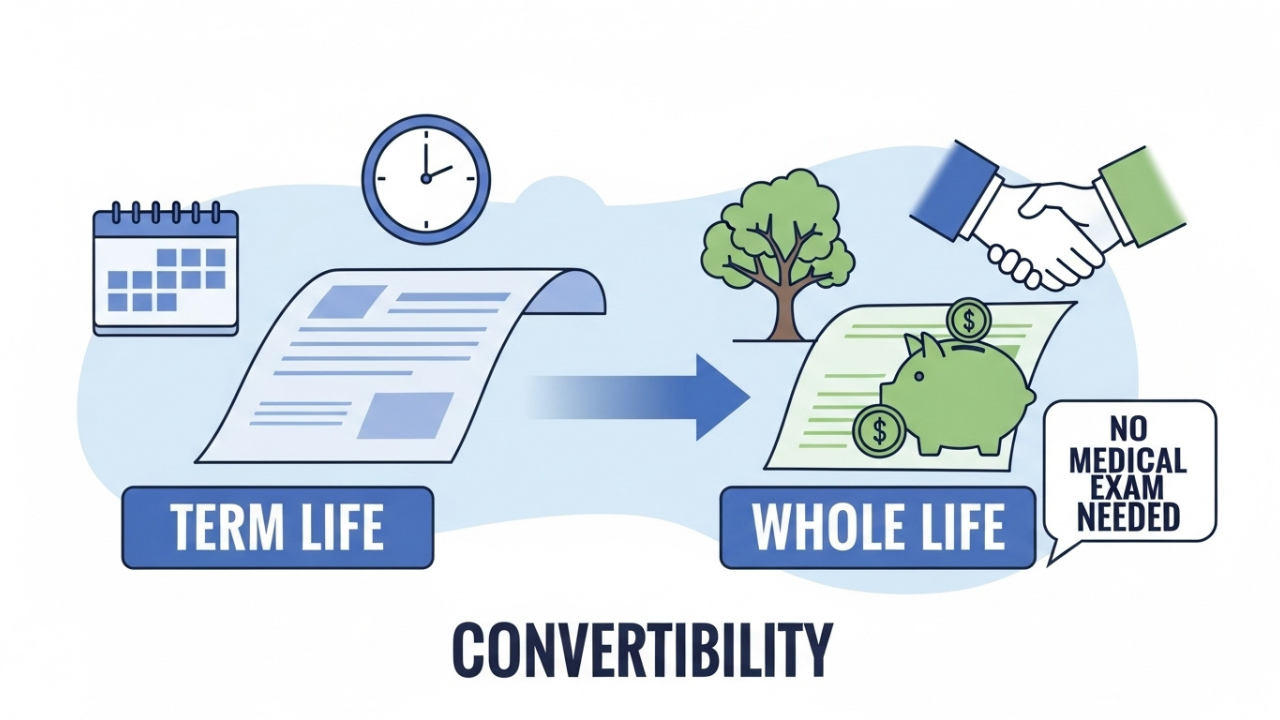

Flexibility and Convertibility: Options Matter

Here’s a tip I wish I had known years ago: many term life policies offer convertibility which means you can change your policy into whole life insurance without any medical exam.

If your health declines and you desire lifelong coverage, this option is incredibly helpful. Make sure to inquire with your agent about this possibility.

How to Decide Which Is Best for You

Whether comparing term life or whole life insurance benefits, it’s mainly a matter of your personal objectives, finances, and your expectations from a life insurance policy.

If you’re looking to cover particular life expenses for an extended period, such as childrearing or a mortgage, then a term life policy would be an excellent and economical option.

On the other hand, if you seek life coverage that lasts for your lifetime and also accumulates cash value that you can borrow against, you may want to consider whole life insurance—though it comes at a much higher price.

Real-Life Examples That Might Help

I’d like to share two brief stories.

When Sarah’s children were young, she bought term life insurance to cover her mortgage. She chose a 20-year policy to cover that time and keep premiums affordable. Now her kids are teenagers, and she plans to review her policy soon.

Mike decided to get whole life insurance because he wanted both a savings component and lifelong coverage. He likes that he can use his policy’s cash value for unexpected expenses. He also appreciates that his family will always be protected financially, no matter when he passes.

Additional Considerations Before You Buy

There are considerations to think about with:

- Health and age — people who are younger and healthier tend to have better rates.

- Budget — what is the most you can afford to pay each month?

- Plans for the future — will your requirements change in the near future?

- Other forms of investment — do you possess any retirement plans?

- Economic inflation — think about whether your benefits are aligned with the rising benefits pay.

How to Get Started: My Step-by-Step Approach

My decision regarding life insurance was guided by the following steps:

- My financial targets alongside insurance coverage were itemized.

- Online, I obtained several quotes for comparison.

- Clarification on various options was obtained during discussions with advisors.

- Comparison between whole life policies and term life policies was performed meticulously.

- A policy that was affordable and comfortable was chosen.

I would not regret my purchase because I followed these processes.

Common Myths About Term Life and Whole Life Insurance

There is an abundance of false information available including myths like outliving term life insurance results in no returns making it useless. Term life insurance serves its purpose in protecting one from severe financial losses during critical phases of life therefore not an investment.

The whole life insurance debate centers on whether it is beneficial or not. Some folks firmly believe it is a fantastic investment. This, however, depends on your individual financial goals. Sometimes you would be better off investing elsewhere.

What I Wish I Knew Before Buying Life Insurance

Looking back, I wish I focused on understanding the significance of policy review and the need for changes in coverage over time. Changes in life such as additions to the family with marriages and children, new jobs, among others, necessitate changes in coverage.

Underestimating the value of face-to-face meetings with an advisor as compared to the do-it-yourself life insurance websites is another lesson I would have benefited from. Supported by my advisor, I came to appreciate unfamiliar terms that had once added to my stress.

Final Thoughts on Term Life vs Whole Life Insurance Benefits

It is perfectly okay to feel confused during the transition from term life to whole life insurance. What is important to note is that one is not in this journey alone. The same questions have been asked by millions of other people.

Do not rush the process. Ask questions. But more importantly focus on your personal narrative. What do you hope to protect? For how long? And lastly, what can your budgets constrains allow?

Life insurance more than just a policy adds to the peace of mind for the policyholders and their loved ones.

Feel free to talk to me if you want to explore your options or if figuring out aspects of your life that need aligning is daunting. Making sense of it all is what I am here for.

Leave a Reply